Our Commitment

ESG – Environmental, Social and Governance

ESG stands for Environmental, Social and Governance often as called sustainability. In a business context, sustainability is about the company’s business model, i.e. how its products and services contribute to sustainable development. It is also about a company’s risk management, i.e. how it manages its own operations to minimise negative impact. United Nations Principles of Responsible Investment (UNPRI) defines responsible investment as a strategy and practice to incorporate environmental, social and governance (ESG) factors in investment decisions and active ownership.

Kotak Mahindra Asset Management (KMAMC) takes into account the principles of Environmental, Social and Governance (ESG) factors and Responsible Investing (RI). These principles are an integral part of the investment process at KMAMC. Embedding these principles in our investment philosophy allows us to be a key influencer for long term sustainable shareholder returns. With KMAMC focus on long term investing, we combine multiple factors in addition to financial outlook to measure risk and opportunities of an investee company.

Kotak Mahindra Asset Management is a signatory to United Nations Principles of Responsible Investing (UNPRI) and is the first Indian asset management company to do so for its entire asset management business. Kotak Mahindra Asset Management is also a signatory to Climate Action 100+. This demonstrates our focus towards securing commitments from the corporate sector. The underlying sustainability agenda is that the Indian corporate sector, individually and collectively, take action to reduce greenhouse gas emissions consistent with the Paris Agreement’s goals.

Our ESG investment process and philosophy

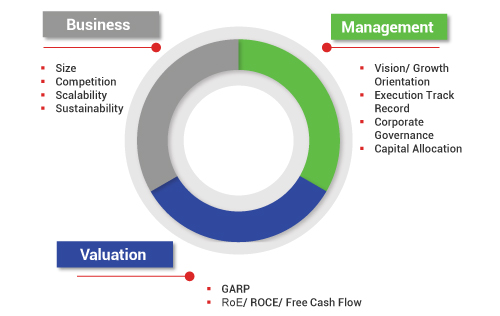

Fundamental analysis is the bedrock of our investment decisions. Our investment philosophy of Business, Management and Valuation (BMV) focuses on sustainability of business and corporate governance. We also believe that ESG issues can influence investment risk and return. Therefore, we incorporate ESG considerations within our fundamental analysis and seek to gain an understanding of the relevant ESG issues applicable to our investments.

|

Articulation of the firm wide strategy and vision

Instituting governance and oversight framework

Integration of ESG factors into portfolio management and scenario analysis

Investment stewardship and engagement with investee companies

Reporting and disclosures

Putting in place the talent and infrastructure needed for ESG integration

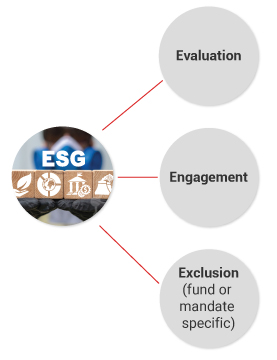

Our approach to ESG: The 3 E strategy

|

Monitoring and over sight

We evaluate companies on ESG parameters not only on a current basis but also monitor the changes that these companies incorporate over time. Changing regulatory requirements will also guide our investment process, engagement and monitoring of our investee companies.

- As active managers, we continuously monitor the companies in which we invest and their ESG scores.

The Investment Committee sets the guidelines for investments and helps formulates and approves policies including ESG related policies and these are periodically reviewed.

The ESG scores assigned by the third party research provider is on the basis of only publicly available information and data. Further, any controversies relating to companies under coverage during the year are tracked and shared regularly by the service provider in order to determine their materiality and impact on the rating of the company, if any. Since the scores are based on publicly available information, they would depend on the public disclosures made by companies on their ESG practices.

ESG research team

- Our Research team consists of analysts who are a combination of sector specialists and mid-market/ small-cap focussed. ESG is an integral part of the overall research methodology of the research analysts.

We have designated our Head of Equity Research as ESG coordinator for KMAMC.

Additionally, we have also strengthened the team with a dedicated ESG analyst.

ESG Policies

Signatory Of

Our Funds

Our Funds  SIP

SIP  Plan Now

Plan Now  Insights

Insights  Services

Services